Florida’s housing market continued its upward swing in February of 2022, with increased inventory and higher median prices compared to the same time last year. However, economic uncertainty, inflation, and fluctuating interest rates above 6% have impacted the state’s housing sector, resulting in a decline in closed sales of single-family homes and existing condo-townhouses.

Key Statistics:

– 21.3% year-over-year decline in closed sales of single-family homes statewide in February 2022

– 30.2% year-over-year decline in closed sales of existing condo-townhouse units in February 2022

– 131.4% year-over-year increase in inventory for existing single-family homes in February 2022

– 106% year-over-year increase in inventory for existing condo-townhouse units in February 2022

– 2.7-months’ supply of existing single-family homes inventory in February 2022

– 3.2-months’ supply of existing condo-townhouse inventory in February 2022

Florida Market Update 2023 Spring

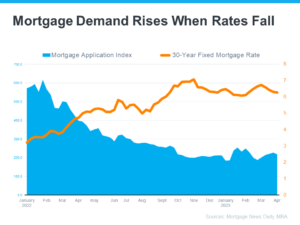

Despite the decline in closed sales, the housing market has shown some positive signs as a result of the 6-6.5% mortgage rate range that spurred some renewed activity in the existing home sales market.

Dr. Brad O’Connor, the Chief Economist at Florida Realtors®, states that the numbers for February were much more favorable than January but warns that a lack of new listings kept inventories from expanding much at all, with single-family inventory declining month-over-month.

The median sales price for single-family existing homes in February 2022 was $395,000, up 3.5% from the previous year, and for condo-townhouse units, it was $315,000, up 8.6% over the same time last year. This indicates a slow build of for-sale homes on the market that will ease inventory constraints in many markets across the state, easing some pressure on home prices and helping buyers deal with affordability challenges.

President G. Mike McGraw of Florida Realtors® believes that working with a local Realtor is essential to understanding the complex and emotional process of buying or selling a home. They help consumers navigate the rising interest rates and affordability challenges while explaining the benefits of buying versus renting a home.

In conclusion, Florida’s housing market has continued to strengthen despite the impact of the pandemic, inflation, and fluctuating interest rates on the state’s economy. The increase in inventory and median prices, along with the support of local Realtors, is painting a hopeful picture for a more stable future in Florida’s housing market.