Real estate investing can be a lucrative way to build wealth, but it requires knowledge, patience, and discipline. Unfortunately, some investors fall prey to certain behaviors that can lead to failure. In this article, we will discuss the seven deadly sins of a failing real estate investor and how to avoid them.

Mistakes Real Estate Investors Make

-

Can’t differentiate between speculating and investing:

Speculating and investing are two different things. Speculating involves taking a risky position in the hope of making a quick profit, while investing involves purchasing an asset with the goal of generating long-term income or appreciation. Failing investors often confuse the two, and as a result, they take on too much risk, overpay for properties, and fail to create sustainable cash flow.

-

Cannot identify real teachers from fake gurus:

The real estate investing industry is full of “gurus” who promise to teach you how to get rich quick. Unfortunately, many of these “gurus” are only interested in selling you their expensive courses, books, and seminars. Failing investors often fall for their marketing tactics and end up spending a lot of money on useless information.

-

Failure to build wealth slowly:

Real estate investing is not a get-rich-quick scheme. It requires patience, discipline, and a long-term outlook. Failing investors often want to make a quick profit and end up taking shortcuts that lead to failure. Building wealth in real estate requires a slow and steady approach that focuses on cash flow, value creation, and risk management.

-

Collects knowledge but never acts on it:

Knowledge is essential in real estate investing, but it’s not enough. Failing investors often spend too much time reading books, attending seminars, and listening to podcasts, but they never take action. Real estate investing requires action, and failing to act is a surefire way to fail.

-

Cannot say “No”:

Real estate investing involves making tough decisions, and sometimes that means saying “no” to a deal or a partner. Failing investors often have a hard time saying “no” because they fear missing out on an opportunity. However, saying “no” can sometimes be the best decision for your portfolio.

-

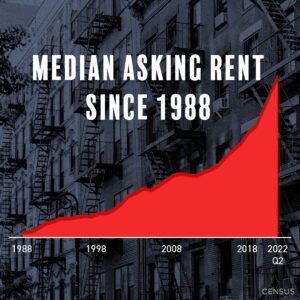

Doesn’t act according to market cycles:

Real estate markets go through cycles of boom and bust. Failing investors often fail to recognize these cycles and end up making bad decisions. For example, buying at the peak of the market or selling during a downturn. Understanding market cycles and adjusting your strategy accordingly is essential for success in real estate investing.

-

Doesn’t fully understand risk and return:

Real estate investing involves taking on risk in the hope of generating a return. Failing investors often underestimate the risks involved and overestimate the returns. This leads to bad investment decisions that can lead to financial ruin. Understanding risk and return is crucial for success in real estate investing.

In conclusion, real estate investing can be a great way to build wealth, but it requires knowledge, discipline, and patience. Avoiding the seven deadly sins of a failing real estate investor will help you achieve success in this field.

Bullet points:

- Can’t differentiate between speculating and investing

- Cannot identify real teachers from fake gurus

- Failure to build wealth slowly

- Collects knowledge but never acts on it

- Cannot say “No”

- Doesn’t act according to market cycles

- Doesn’t fully understand risk and return